For a limited time: The first 50 who get JUST In-Time loan receive a meeting with a tax specialist for 2024.

%20(Facebook%20Post%20(Square)).png)

Stay In Control of Your Finances

Cover Unexpected Expenses with the JUST In-Time Personal Loan.

JUST In-Time is for you if have:

-

Concerns for Tax Season

Managing your business finances can be complex and stressful, especially when it comes to tax preparation.

-

Unplanned Expenses

Every entrepreneur deserves the opportunity to pursue their goals without being held back by financial stress.

-

A Loan Partner Ready

You a friend, JUST client or simply a trusted individual to serve as a partner borrower.

Most Americans are not prepared for unforeseen expenses.

Also, a survey conducted by Bankrate in 2019 found that only 41% of Americans could cover an unexpected expense of $1,000 with their savings.

How JUST In-Time works:

Frequently Asked Questions

What is a JUST personal loan?

It's a versatile loan that you can use for whatever you need. It's perfect for emergency situations or unexpected expenses. The loan can be between $500 - $1,000 and includes a personal development course.

What do I need to apply?

Like all JUST loans, it requires two participants.

If you're an existing customer, your current JUST loans must be up to date, and you must have an identified trusted partner.

If you're not a JUST customer, you need an invitation from an existing customer.

When are the funds disbursed?

Applications are processed weekly and close on Fridays every week. If your application is completed and approved by Friday EOD, your loan schedule begins the following Wednesday.

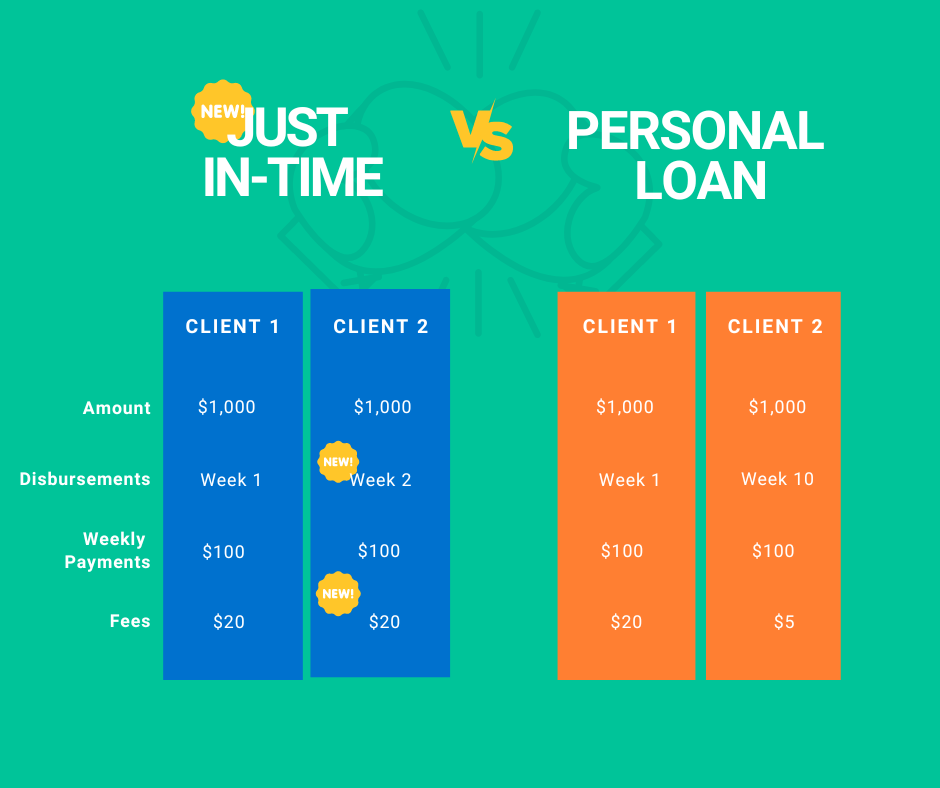

Member #1 receives funds week 1

Member #2 receives funds week 2

What is the cost of the loan? Does it have any interest?

This loan has no interest, but the cost is $20 per participant. This cost will be deducted when you receive your loan.

What are the weekly payments?

Weekly payments are $100 for 10 weeks, every Wednesday.

What if I'm not a JUST member, but someone from the community invited me?

If you're not a JUST member but someone from the community invited you, follow this simple step to start your process of becoming a JUST member.

How will I make my payments?

JUST uses a platform to give you access to make your payment with cash at different stores like CVS, credit card, or bank account. You'll have access to the platform from your portal the day before your first payment.

Can I pay my Tanda in advance?

You can make a payment for more than what is owed, but this won't affect the predetermined time of the personal loan, including disbursement and renewal.

For a limited time: The first 50 who get JUST In-Time loan receive a meeting with a tax specialist for 2024.

Funds for your more urgent needs. FASTER.

Our new personal loan offering is designed to provide even more support to female entrepreneurs in times of urgent need.

%20(Facebook%20Post%20(Square))%20(2).png?width=1080&height=1080&name=Mustard%20Yellow%20Support%20Thread%20Facebook%20Post%20(Canva%20Banner)%20(Facebook%20Post%20(Square))%20(2).png)

About JUST

JUST is a non-profit financial platform working to close the racial wealth gap by investing in ambitious Texas women.